by Garrett Fisher

April 7, 2014

Debates not only abound, they are endless when it comes to how to manage an economy. These debates are secondary and tertiary to critical underpinnings; namely, that the matters being discussed: should welfare exist, should regulation be increased or decreased, how much debt is acceptable and when – these are riding above simpler, more profound, and more essential components to an economy that works. In essence, those debates speak of what kind of economy a society chooses to have and misses the fact of whether or not a system will work.

In The Human Theory of Everything, I made a statement that any economic system, from free market capitalism to communism, failed for the same reasons. They used money as a transfer mechanism and, when society fails to contribute as the system is set up, then the system collapses. In the case of communism, while communal ownership and centralized government control of the economy was radical and disliked, the system that was set up collapsed because participants did not contribute sufficiently to support it. The Western world of today has rising debt to GDP levels, so something there is not sustainable also. Both societies are yielding to the short-term temptation to underfund society as it is currently set up.

Normally, this kind of discussion would descend into a near fistfight powered by impassioned rage over personal political views. Again, I point out that those views are the type of society we would choose to have – a loose, unregulated one all the way to no freedom at all. Whether any of those systems would work is simpler than such an argument. Therefore, this article will not discuss if we should have free market capitalism, a social market economy, socialism, communism, or anything else. That is an irrelevant discussion.

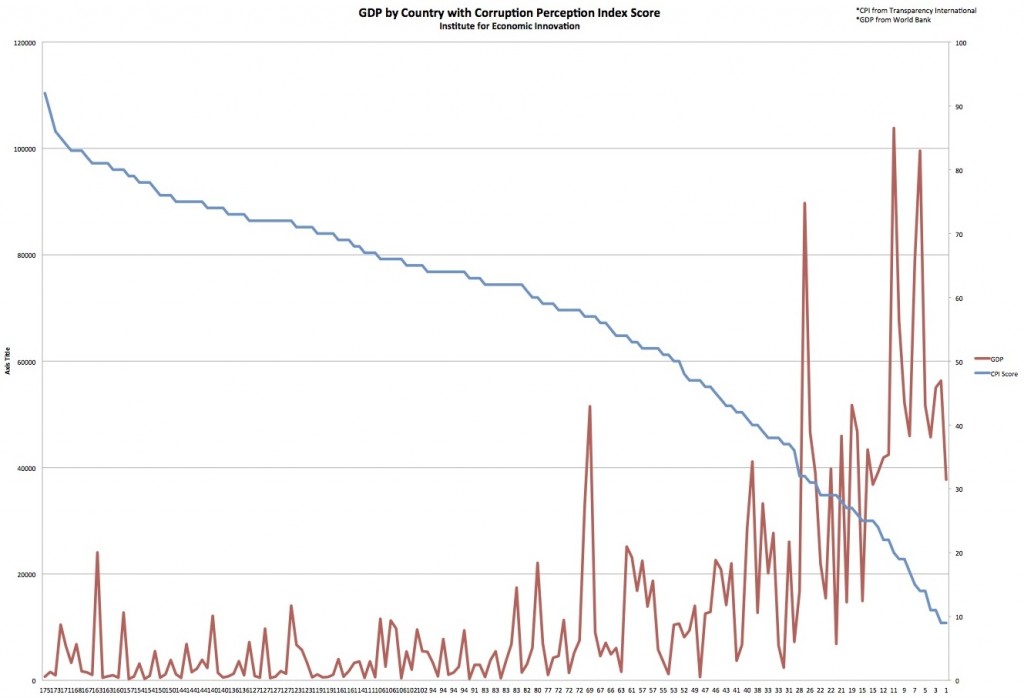

To lay the groundwork for understanding this foundation, two datasets have been overlaid on the following graph. The red line represents GDP, per capita, in US dollars by country. The blue line represents the Corruption Perception Index – which measures how society perceives corruption in their country. The CPI was plotted in descending order (highest corruption to lowest) and associated GDP was then plotted to see what happens. You will note an interesting correlation.

Generally speaking, the higher the corruption, the lower the GDP. This tells an important story. Corruption represents a breach of trust – that key components of an economy, regulators, are not doing their job. In fact, they are not only doing their stated job, they are likely doing opposite of it for short-term, personal gain. A highly corrupt system means that many of the components of an economy are looking after themselves instead of the overall system. There is far less trust – or none at all.

How is this important? In a blatantly corrupt society, things cost more and take more time. Government inspectors are unpredictable and slow and while there may be direct bribes or tips necessary to get the regulator to do what is expected, that amount may not be known. Are there competing influences that require a larger bribe or favor? Due to the lawlessness of corruption, cost estimating is made harder to impossible; therefore, risk goes up. When risk goes up, so does uncertainty. Economic activity drops, and prices go up due to risk and less economies of scale. When the components of a system fail to individually do their job, it is like sand in the engine and the system breaks down.

That is all well and good for undeveloped, third world nations. What about the developed world? While we may replace “corruption” with “lack of trust,” the issue is the same. Companies are reticent to hire employees unless they know that they will deliver. Will an employee get the job done? Will they fake their time sheet? If a company knew that an employee would be able to do a job and would do it, the economy would move faster as companies would undertake progressively more ambitious projects. In fact, the sluggish recovery in employment numbers has been attributed repeatedly to a skills mismatch. Therefore, corporations are sitting on almost foolish amounts of cash – neither investing nor returning to shareholders – simply holding on to it until an opportunity arises. A skill mismatch represents risk. Why should a company hire an employee that needs to be trained when it may all be for naught? US economic results tell us that they conservatively opt not to.

Developed world risk goes further. If an employee is hired and has an injury on the job, the entire workers compensation claim system is engineered to detect and avoid fraud. Imagine the expense reduction if only legitimate claims were made. Developed social welfare systems are constantly under political discussion because of the vast amounts of fraudulent welfare and disability applications. Not only is tremendous money and expense going out the door, think of the economic possibilities we do not experience because of fear due to breaches of trust. According to the Internal Revenue Service, only 70% of federal income tax is collected of what should be under current regulations. The list goes on – and the conclusion is that fraud and breaches of trust hurt the entire system by introducing fear and reticence. While not overtly corrupt, the system is undermined by each component not living up to the agreed upon and stated mechanisms for which the economy is designed.

Notice that the corruption vs. GDP chart did not include what form of governance each country had. Almost every country in the world was included in the chart – first and third world – from almost no regulation to outright communism. Despite ignoring forms of government and economic systems, the results were the same: less trust means a less productive economy.

That tells us that whether an economy is anywhere in the pendulum of political type, it would work if each component in the economy did their job and followed how the system was designed. Inevitably, one cannot say that differing forms of government would produce the exact same production amounts. However, it is noteworthy that trust has a greater impact on production than quantity of regulation. Political discussions of regulatory quantity and type are secondary and tertiary to greater factors.

Interestingly, politics is ostensibly arguing over what regulatory framework would work best. “Best” meaning which system has maximum safety, maximum freedom, lowest cost, and highest effectiveness. Opinions abound and are fought over because each participant begins to introduce what would motivate them personally – and the entire discussion is one to two layers removed as the wrong matter is being discussed. What motivates a politician probably does not motivate the components of the system undermining. Thus, political arguments become arguments really over personal beliefs and how to impose those onto society. The temptation that such a form of approach works is in the event a personal view of a politician is made into law and serves to actually address trust in the economic system positively. Such a process is as far as humanly possible from scientific and relies on emotion and trial and error as pillars.

Complex problems are often met in society with ever increasing complex proposals to solve them. If a problem is pervasive across a system and evades proposed solutions, then complexity is probably not the answer. Rather, a simpler issue once compounded and mixed with other variables is usually the culprit.

Breaches of trust are rooted in short-term thinking that is related to a corrupt person’s lack of trust in the system. Some people who commit fraud outright are simply malicious and motivated by short-term gain at the expense of long-term consequences and systemic possibilities. A larger amount of people simply understand that, while following the design of an economy is better overall, they do not trust that it will benefit them and instead opt for short-term motivation to protect themselves. That, in turn, is a reinforcing cycle of despair that further compounds the problem. While this article does not set out to propose a solution to the problem, understand that the source and solution of these forms of thinking are surprisingly basic.

Notes to Datasets

GDP per capita in USD was acquired from the World Bank. 2012 is the year used. Approximately 5% of countries did not yet report 2012, so 2009 to 2011 data was substituted with no adjustment for inflation in that country.

The Corruption Perception Index (“CPI”) was for the same year and derived from Transparency International’s data set. Less than 3% of countries were deleted as they did not have a combination of GDP and CPI data – either one or the other existed.

CPI was inverted. Transparency International measures high corruption as a low number and low corruption as a high number on a scale of 0 to 100. Thus the CPI may indicate 91 for a low corruption country. That was inverted for display purposes to 9 and vice versa for high corruption countries. Showing increasing GDP with an increasing CPI would imply that corruption benefits GDP – which is obviously not the case.