by Garrett Fisher

April 23, 2014

It is a paradoxical if not somewhat ironic reality that small business owners are rife with fantasy when talking about growth. Growth is seen as a linear path to riches, security, happiness….ah…..an IPO. What could be more divine than that? Hence, off the business owner goes forecasting growth for the next 5 years. “We’re at one million revenue this year, so we’ll be at two million next year, four the year after that, then 8 and 16. Maybe I’ll run it up to 32 million in revenue and sell out for 100 million at that point.” Meanwhile, the person is driving a beat-up minivan and is in regular negotiations with his mortgage lender to avert foreclosure.

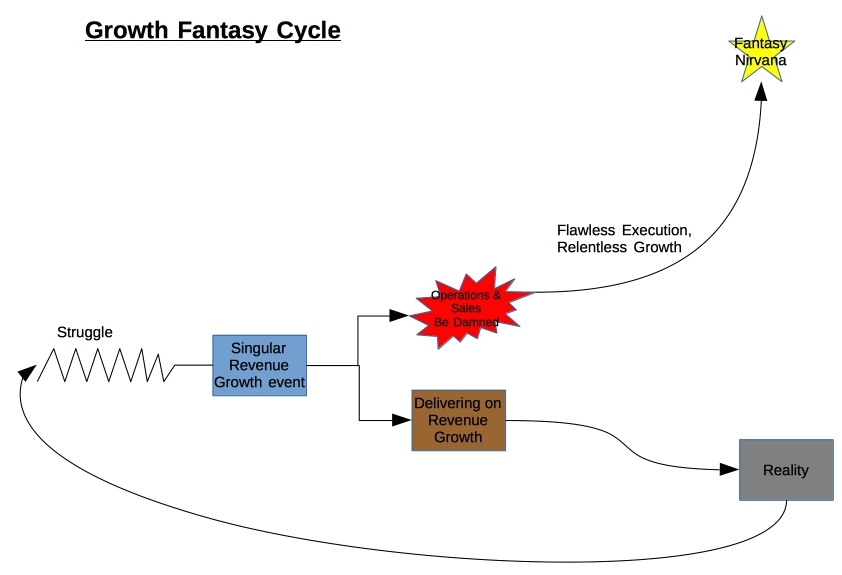

While it sounds silly, it is unfortunately bizarrely common. The formula seems to be that a business owner lands a contract or does something relatively singular to grow revenue in one year. Then, the assumption is made that such an outcome can be repeated every single time without failure and that not only can the growth rate be sustained, it will be accelerated….flawlessly. If 100% growth is possible once, then it is possible every time, such that the 1,2,4,8,16,32 phenomenon comes into play. All of these fantasies have a glorious crescendo ending in an orgy of cash and a life sailing the Caribbean on a luxuriant yacht.

The logic behind the scenario is inviting. The first reality is that most entrepreneurs struggle with trial and error and failure to achieve the first sizable sale. The sales cycle may have been a reasonably long period of time – 6 months or a year – and execution is still an ongoing concern. Although a contract is signed or a location opened, will the variables needed to sustain a successful enterprise remain? More than likely, challenges abound to deliver on recent growth, much less acquire more of it.

The second issue is the fact that, to sustain growth at such a rate, there needs to be systems in play delivering on it. While a challenging new customer and revenue growth can be replicated, how will they be replicated at 4X or 8X the growth rate? Surely the founder cannot do it all himself or herself and thus, new employees are needed. Can they deliver at the same rate as the founder? What about the lead time it takes to train these new employees? The matter of operations and delivering on increased sales is a matter of weighty significance as the founder will likely be involved with replicating expertise on the operations side. Explosive sales growth and operational efficiency is very challenging.

The main point of why such forecasts do not work is related to the fact that little thought goes into how it will be pulled off. Unlike a new product or technological development, raw growth is the hardest to deliver unless the market wants it. Somehow, founders and entrepreneurs get something in their minds that they are in control of the marketplace. In reality, the success stories of garage-to-IPO tech companies occurred on the backs of a market that was wildly demanding the product being sold. If what a company is selling is not naturally flying off the shelves, creating a linear “we’re going to grow” forecast is a waste of time.

Very well the largest issue of such growth fantasies has to do with the mental and emotional distraction going on in the chief executive’s mind. Why would a leader of a company be compelled to make such inane forecasts and, much worse, put any faith in them? Behavior of this sort, absent a viable plan to execute it, is indicative of a host of leadership issues.

The first problem is that the leader prefers to operate in the future and in fantasy rather than the present. In my consulting practice, I have seen many instances where the problems of the present were so grievous that fantasies of growth were used as a coping mechanism. The second problem is that the leader is unable to deal with the present. Operations management and true revenue growth is a challenge requiring dedication, hard work, and expertise. For a CEO that prefers to avoid thinking about those vital building blocks, the indication is that he or she is an ineffective leader.

A matter of thoughtful concern is why so many business owners will exert so much effort to underachieve at an unattainable goal. IPOs and selling out for 9 figure sale prices are extremely rare – even more so without significant infusions of capital or debt. In other words, a founder rarely gets to keep all of such an exit anyway. So why do so many work so hard at something they probably will never attain?

I see a common behavior trend among these types. There is an almost mystical figure in their mind of a high-society businessperson making deals, jet setting, and placing capital on an ongoing basis. In the mystical fantasy, there is a life of ease, luxury, and power playing – and it appeals to something inside people of this sort that such a life is enviable and worth sacrificing decades to attempt to achieve.

What is ignored in these fantasies is a healthy dose of reality. The amount of “power players” in this role is very few. They are somewhat interdependent as rarely is a deal done with one person, in cash. Banks and investors are routinely involved. All the more so, why does a person have to stake their self-esteem on such a goal? Self-esteem is generated internally and is not dependent on external validation by others. Letting others dictate our self-esteem is akin to emotional enslavement and is unnatural. Founders and entrepreneurs that feed on this kind of negative validation undermine the success they already have and lead themselves down the all too common path of personal boom and bust financial cycles yearning for the unattainable. We would all do well to avoid such thinking.